Quick Commerce: The Ultra Fast Online Shopping

This article is a comprehensive discussion on Quick Commerce, which is a relatively new business model compared to the traditional e-commerce, grabbing everyone’s attention and shaping the ecommerce market in a new way. This discussion includes the definition, market, existing companies, unique features, timelines, prospects, challenges and future of the business model.

Quick Commerce is gaining popularity

Quick Commerce is gaining popularity because it gives the customer instant gratification by delivering items to their doorstep quickly in less than an hour. The significant growth in online supermarket purchasing mainly started from the COVID-19 pandemic, and since then the market is observing an enormous necessity of rapid delivery services. This emerging trend suggests that QC companies have substantial potential to exert considerable influence over future consumer buying behaviours. The increasing popularity of this new ultra fast business model has already started to be a part of everyday shopping habits of contemporary times. This business model falls under the subset of the Fast-Moving Consumer Goods (FMCG) industry; for instance, companies such as Getir, Flink, Gorillas, and others.

1. What is Quick Commerce actually?

Quick commerce is a business model based on the idea of delivering goods at ultra-fast speed, typically within an hour or less. This model is mainly serving consumer’s small needs and convenience-based orders like groceries, snacks, and household goods of daily necessities. People also call it Q-Commerce in short. The concept of the model relies on the efficiency of small-scale local distribution hubs. These distribution hubs are known as dark stores. The dark store only stores a selective collection of essential and high-demand items to speed up the order fulfilment.

Key Features

- Speed: Speed is the main attribute of this business model. Deliveries are commonly completed within 10–30 minutes. This is the key selling point of quick commerce over traditional e-commerce.

- Local Hubs: Orders are distributed from centralized local hubs or warehouse. Inventories are kept in an array of self’s so that quick picking and packaging can be done. Generally order size is small. A few items of minimum amount for instance 20 Euros. These are high-frequency product purchases that are for immediate needs.

- Selective Inventory: The operation of this model prioritizes fast-moving of high-demand products that limit the stock collection to selective essential goods. The selective inventory approach is taken mainly to reduce inventory management complexity and ensure rapid picking and packaging.

Why it is Trending

- A shift in consumer expectations: Normally ecommerce has a standard of next-day delivery. In recent times customer expectations started to evolve in demanding even quicker solutions for immediate needs within the same day of ordering. That creates a demand for instant deliveries as quickly as possible.

- Technological advancements: The contemporary technological advancement made it possible to facilitate instant product delivery. The introduction of e-bikes, development of cycle lanes on roads and establishment of urban local fulfilment centres has made it possible for companies to deliver items in under an hour.

- Urbanisation and lifestyle trends: Nowadays more people are living in cities and leading busy lives. That is creating a growing demand for instant access to essential goods without visiting a physical store, especially to save time for shopping. This quick commerce makes it possible to order and receive the items on the doorstep while you are engaged in your work.

This business model is rapidly shaping the future of shopping online, merging convenience and immediacy with the power of digital and logistics innovations.

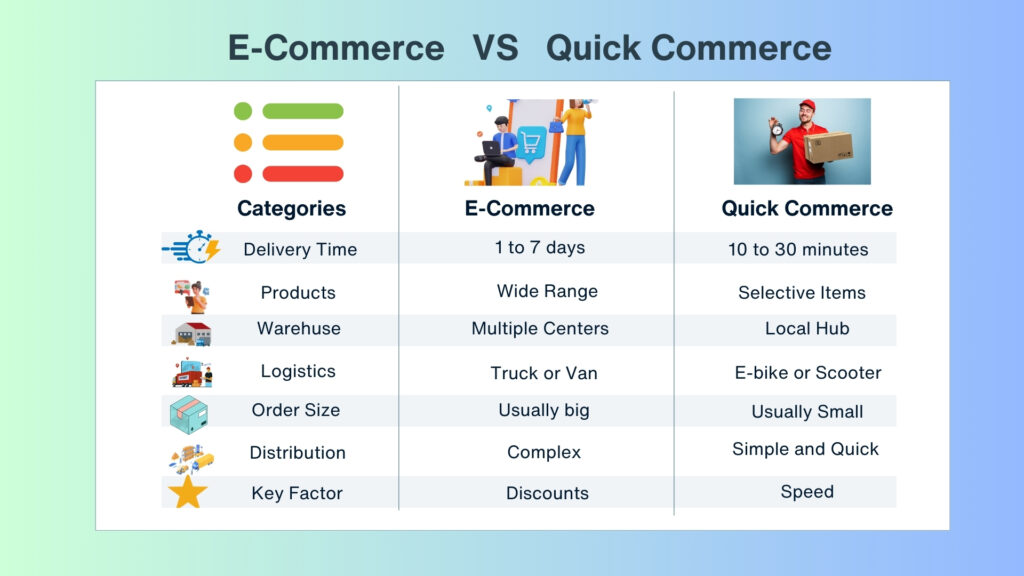

Quick Commerce vs Ecommerce

There are some key differences between traditional e-commerce and quick commerce, for instance in the category of quickness of the delivery, selection of inventory, logistics and distribution pattern.

For Traditional Ecommerce:

The typical e-commerce generally delivers online purchased goods on the next day or within a few days up to a week or even months in some cases, depending on the delivery time mentioned on the website. Companies like Amazon, Ebay, and Aliexpress are dominating this usual form of e-commerce market. Notably, traditional e-commerce is able to offer a wide range of products and a variety of collections, because of its widespread supply chain management. They need multiple fulfilment centres and distribution channels to fulfil their orders, which is also a timely hustle to fulfil considering the wide range of products that come from different sources. For normal ecommerce, companies usually use delivery trucks or vans as the main means of logistics to deliver items to the customer. Here, customer satisfaction is mainly based on the discounts, sale offers and wide range of product varieties. Behavioural economics is the main game changer here.

For Quick Commerce:

Whereas, the quick commerce model’s main feature is delivering online orders not only on the same day but also within a few minutes up to an hour maximum. Companies like Getir, Flink, Gorilas etc. are examples of this business model. Unfortunately, this style of business is unable to entertain customers with a wide range of product collections, because it needs to keep its product collection short to quickly fulfil its orders. The distribution is run by setting up a local warehouse located usually in the centre of the city to cover up order fulfilment up to a five kilometre radius. Selective products are shorted in an array of selfs on the local hubs so that pickers can pick and pack the orders in a minute or so. For QC, companies usually use e-bikes or scooters as the main means of logistics to deliver items to the customer quickly by bypassing the traffic congestion or long route. Here, customer satisfaction is mainly oriented on the quickness of the delivery. “Speed”, that means time of the delivery, is the main game changer here.

Target Customers

The major demographic groups that this business services target are young professionals, urban residents, and technologically adept consumers who priorities convenience and efficiency in their shopping experiences due to their day to day busy life or saving time. These consumers frequently engage with mobile applications for placing orders and expect prompt delivery services specially in top tier countries.

A recent survey by Bernstein reveals that millennials, particularly those aged 18 to 35, exhibit the highest adoption rates, with 60% of individuals aged 18 to 25 preferring Q-commerce platforms over conventional retail options. Furthermore, digital channel adoption for QC extends to consumers aged 36 and older, with over 30% in this group expressing a preference for these services.

QC Product Categories:

When you look closely at what Q-commerce really delves into selling, you’ll find items we use essentially daily, or when there’s a quick need, such as groceries, ready-to-eat meals, snacks, getting your medicine, or even grasping some household things and gifts. It is primarily focused on delivering items to people swiftly because, to tell the truth, it’s mostly items we need right away. Bernstein’s collected some data saying that QC can keep prices great at approximately 10% to 15% cheaper than what you’d spend at your local stores, and still make a decent profit of approximately 15%; they pull this off by cutting out the middlemen; those special warehouses or basically inordinately speedily delivery stores have bumped up what they offer, going from offering around 2,000 things to aiming for up to 12,000 items; they make sure they’re never running low by filling up on goods two to three times every single day because it seems, a lot of people want material fast. Now, despite groceries already being a massive market in India, worth more than half a trillion dollars, there’s room for this business model to dive into other items; take electronics, which make up nearly half of the sales for major online shops such as Amazon and supermarkets. At its most basic level, QC is focused on getting items people use a lot or need in a pinch, without all the extra bells and whistles. But, in truth, it’s looking like they could turn into a pretty major deal if they play their cards right in busy cities.

Major Players Globally

Gorillas appeared in Germany and were noticeably focused on delivering groceries inordinately speedily, even in 10 minutes straight to your doorstep, similar to other rapid delivery services. They were fond of teaming up with local brands so people could get what they enjoy right where they live. A strategy enabled them to expand to places such as France and the Netherlands very quickly, thanks to their many stores in cities.

Then, from Turkey, Getir landed with a flashy idea to also get your shopping to you inordinately speedily, in 10 minutes too. Clearly, Getir wasn’t only staying in Turkey, they quickly moved into Europe and became very noticeable, especially in the UK and Germany. That bright purple they mastered made them pretty hard to miss, and hitting the scene early definitely made them stand out.

Meanwhile, Jokr in New York thought it’d be intelligent and informed to not simply remain in one spot, so they expanded across the Americas. No matter if you’re in the U.S., Mexico, or Brazil, they can help you get groceries without the wait. In addition, they are primarily focused on not destroying the Earth and even selecting goods so it feels tailor-made for each city.

Gopuff began things in the U.S. aiming to help you with snacks, drinks, and even meds for those late-night needs, then moved onto stocking groceries and more. Each of these companies is being independent to move the needle on getting you your items quick. It is interesting to observe them cater to local tastes and not simply adhere to their origins, demonstrating that they are inherently, or in substance, similar to keeping everyone on the same page regarding wanting things fast and convenient.

Flink, a fast commerce business from Germany, has gotten major in Europe really quickly thanks to making intelligent and informed partnership moves. It works in several cities across Europe, especially a lot in Germany, France, and the Netherlands. One of its strikingly large deals was teaming up with the major grocery store REWE; this connection gives Flink the chance to offer more products, so they can give people what they want better.

Challenges Faced by Quick Commerce Companies

Workforce Management: The model depends heavily on delivery drivers and the people working at the fulfilment centres. High quits and job switches, especially because everyone wants their items really quickly, mean it costs more to find and train new people to speed.

Intense Competition: The conflict to be the best in quick commerce is very hard. You have not simply the speedy delivery groups but also the major e-commerce giants such as Amazon and Walmart entering into the super-fast delivery industry. They use their very big groups of connections and large amounts of money to keep up, making it hard for the specialised quick commerce teams to stay ahead.

Operational Costs: To actually be able to do quick commerce, companies need to set up several dark stores close to where people live. On top of that, having a substantial portion of vehicles to bring packages costs a great deal of money, especially when the price of gas changes a lot; this makes it hard to keep spending under control.

Conceptually, quick commerce businesses are having trouble delivering items extremely quickly, without draining their wallets, all while dealing with people leaving jobs faster, and fighting off some very strong rivals.

Growth Opportunities of QC Despite Challenges

Research shows that the market for QC in Europe was worth approximately €4.5 billion in 2022 and is expected to almost double to €8.7 billion by 2027. Notable is that the UK, France, and Germany are expected to lead a surge. Still, earning money from a business is hard. The manner in which orders are put together takes a lot of work, which eats into profits. In addition, everyone wants their items inordinately speedily, which means you have to be very organized, especially in cities. It’s even harder to make it work outside of cities.

So, for now, it looks like the service will mostly hold to urban areas because of all the red tape of trying to set up in the countryside, but this is not just about groceries now. There are some major obstacles, but people are fond of getting all sorts of items delivered instantly. In Germany, 78% of people think fast shopping is a major issue, 75% in the Netherlands feel the same, and in France, it’s at 69%. That means QC could play a strikingly large part in how we buy an entire group of different things not simply our weekly food haul making it extremely useful for all sorts of shopping needs.

Is Quick Commerce Sustainable?

Yes, quick commerce is sustainable.

Is Quick Commerce Profitable?

It is difficult to say quick commerce is profitable or not at this moment.

Influencing Factors for Customer Satisfaction in Quick Commerce in the Netherlands

This is a masters thesis in 2024 on the topic Factors Influencing Customer Satisfaction in Quick Commerce in the Netherlands.

You can buy the thesis paper full book from amazon or google play book store directly for full documents:

or, https://www.google.nl/books/edition/Quick_Commerce/l88KEQAAQBAJ